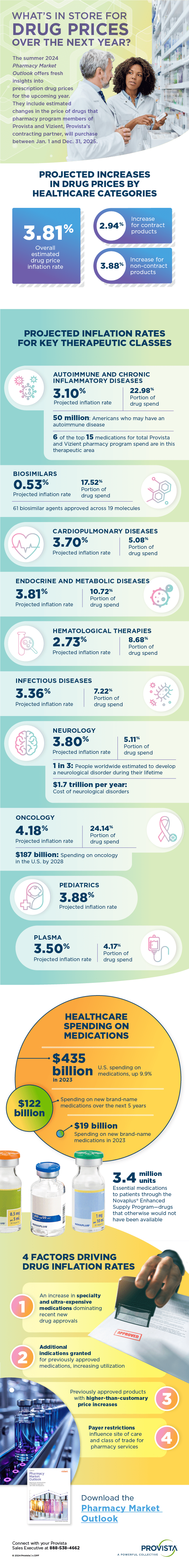

PROJECTED INCREASES IN DRUG PRICES BY HEALTHCARE CATEGORIES

3.81%: Overall estimated drug price inflation rate

- 2.94%: Increase for contract products

- 3.88%: Increase for non-contract products

Autoimmune and chronic inflammatory diseases

- 3.10%: Projected inflation rate

- 22.98%: Portion of overall program drug spend

- 50 million: Americans who may have an autoimmune disease

6 of the top 15 medications for total Provista and Vizient pharmacy program spend are in this therapeutic area

Biosimilars

- 0.53%: Projected inflation rate

- 17.52%: Portion of drug spend

- 61 biosimilar agents approved across 19 molecules

Cardiopulmonary diseases

- 3.70%: Projected inflation rate

- 5.08%: Portion of drug spend

Endocrine and metabolic diseases

- 3.81%: Projected inflation rate

- 10.72%: Portion of drug spend

Hematological therapies

- 2.73%: Projected inflation rate

- 8.68%: Portion of drug spend

Infectious diseases

- 3.36%: Projected inflation rate

- 7.22%: Portion of drug spend

Neurology

- 3.80%: Projected inflation rate

- 5.11%: Portion of drug spend

- 1 in 3: People worldwide estimated to develop a neurological disorder during their lifetime

- $1.7 trillion per year: Cost of neurological disorders

Oncology

- 4.18%: Projected inflation rate

- 24.14%: Portion of drug spend

- $187 billion: Spending on oncology in the U.S. by 2028

Pediatrics

- 3.88%: Projected inflation rate

Plasma

- 3.50%: Projected inflation rate

- 4.17%: Portion of drug spend

HEALTHCARE SPENDING ON MEDICATIONS

- $435 billion in 2023: U.S. spending on medications, up 9.9%

- $19 billion: Spending on new brand-name medications in 2023

- $122 billion: Spending on new brand-name medications over the next 5 years

- 3.4 million units: Essential medications to patients through the Novaplus® Enhanced Supply Program—drugs that otherwise would not have been available

4 FACTORS DRIVING DRUG INFLATION RATES

- An increase in specialty and ultra-expensive medications dominating recent new drug approvals

- Additional indications granted for previously approved medications, increasing utilization

- Previously approved products with higher-than-customary price increases

- Payer restrictions influence site of care and class of trade for pharmacy services

Download the Pharmacy Market Outlook.